Will Your Money Last as Long as You Do?

Check out this 8-page guide to see why a retirement income analysis could mean the difference between enjoying retirement or white-knuckling your way through it.

- Learn how an experienced financial professional can address your “what-ifs” about retirement — and then help you figure out workarounds.

- Read how the average person spent $146 a year on health care in 1960 compared to the average cost today. (It’s a whopper!)

- Make sure you’re asking the right questions about retirement: How do I make my money last? What can I do to minimize taxes? How could a long-term care strategy help my family’s long-term medical needs?

Are You Paying Too Much In Taxes In Retirement?

This 8-page tax guide was created for you to better understand how taxes could affect your retirement income, including:

- Separating your taxable and tax-deferred accounts

- The signs to watch for in ever-changing tax laws

- Options for tax deductions in retirement income

The Greatest Gift: Outline Your Wishes With an Estate Plan

Check out this 12-page guide to communicating your values and goals to help your loved ones through tomorrow:

- Areas your will should address (and who should write it)

- The two types of trust — and how they can help reduce the chance of a family conflict

- A checklist to help you select the right person to carry out your wishes

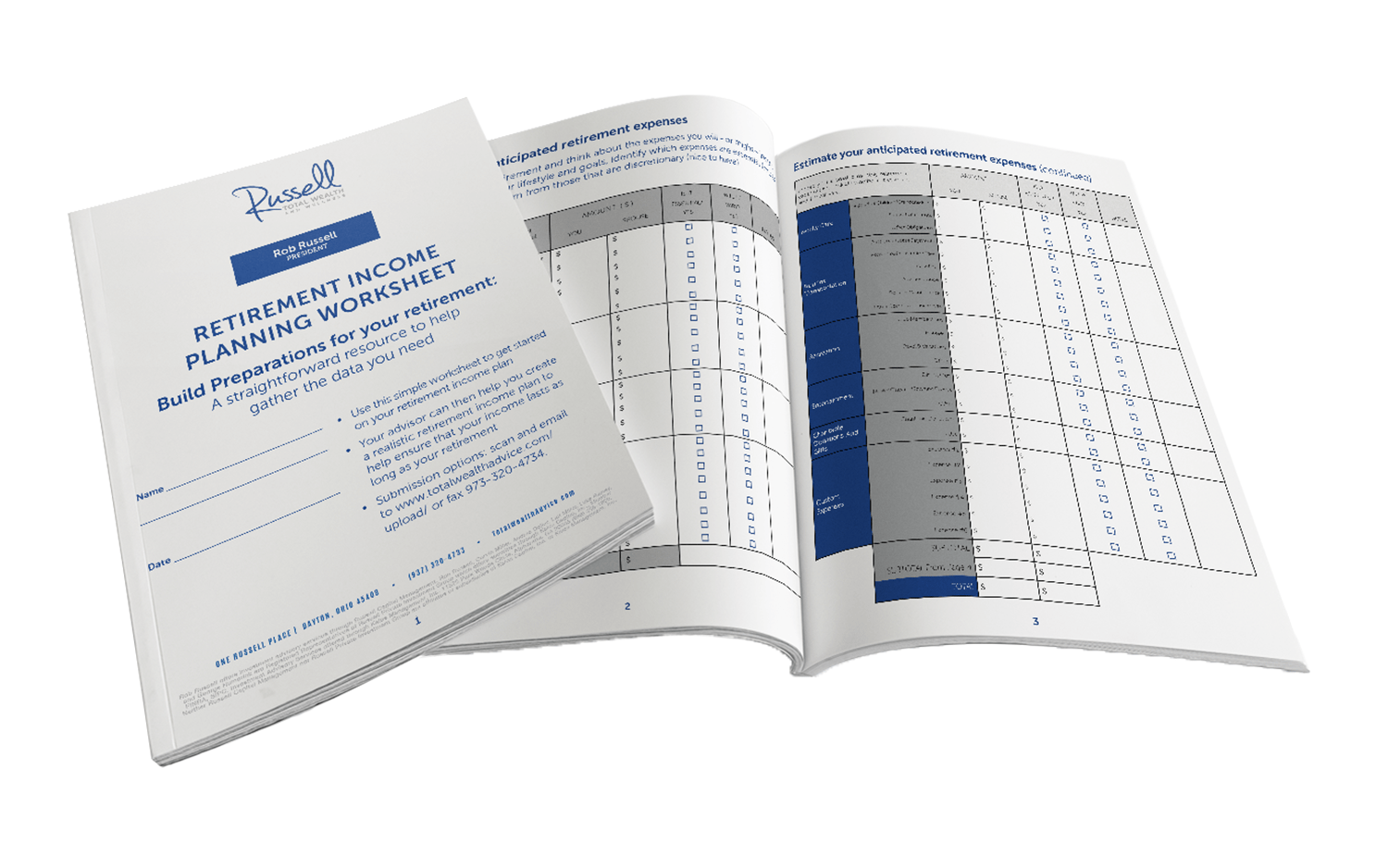

Build Preparations for your retirement:

A straightforward resource to help gather the data you need. Use this simple worksheet to get started on your retirement income plan.